Some Known Incorrect Statements About Simply Solar Illinois

Table of ContentsThe Greatest Guide To Simply Solar IllinoisThe Single Strategy To Use For Simply Solar IllinoisGetting The Simply Solar Illinois To WorkSimply Solar Illinois for BeginnersThe Facts About Simply Solar Illinois Uncovered

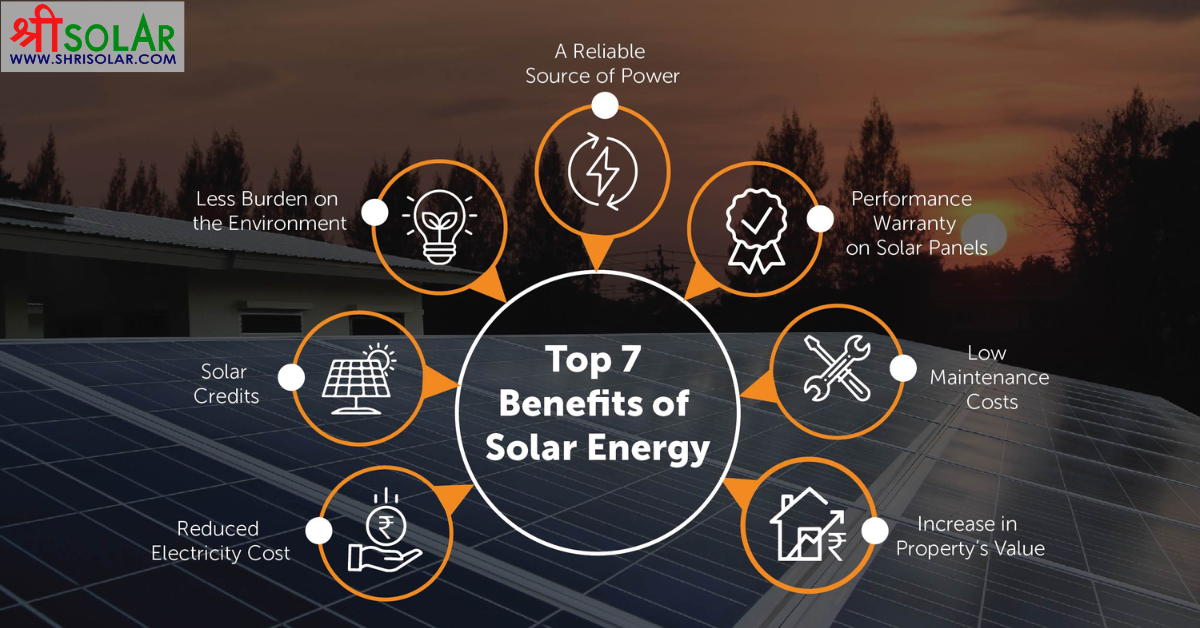

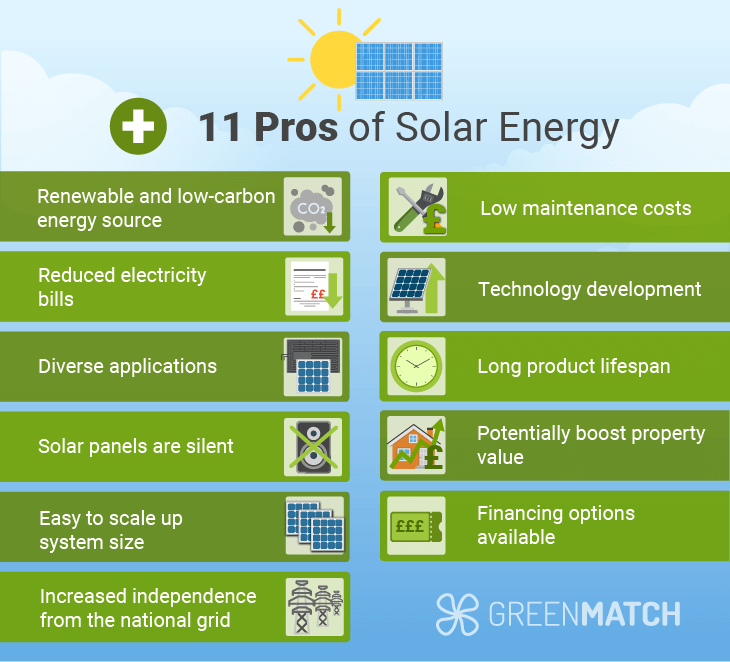

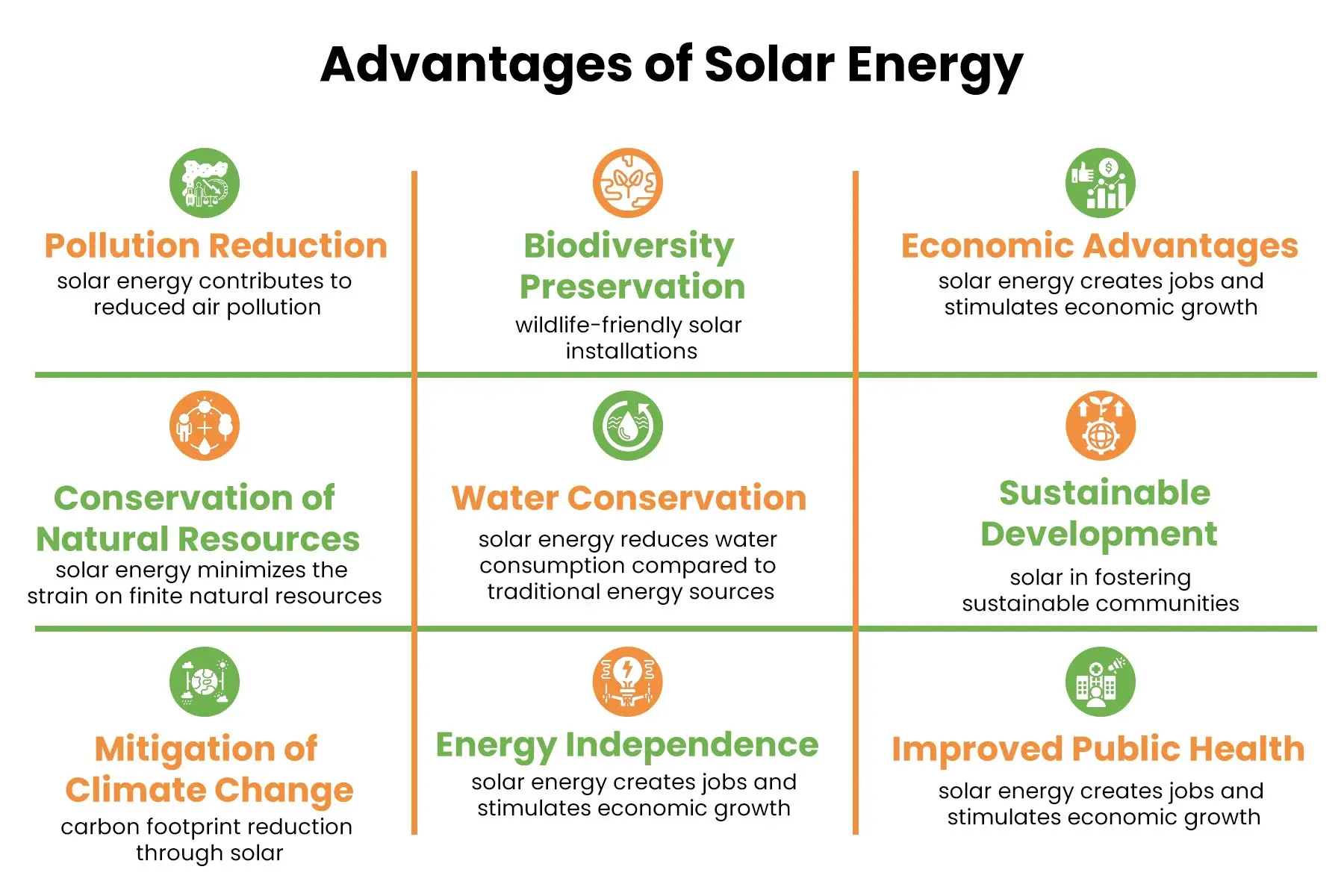

Our group companions with neighborhood communities throughout the Northeast and beyond to deliver clean, cost effective and dependable power to foster healthy communities and maintain the lights on. A solar or storage space task supplies a variety of advantages to the community it offers. As innovation advancements and the cost of solar and storage space decline, the financial advantages of going solar continue to increase.Support for pollinator-friendly habitat Environment repair on polluted sites like brownfields and garbage dumps Much required color for animals like lamb and fowl "Land banking" for future agricultural usage and soil top quality improvements Because of climate adjustment, severe climate is coming to be more regular and turbulent. As a result, home owners, companies, communities, and energies are all ending up being an increasing number of interested in protecting energy supply solutions that provide resiliency and power safety.

In 2016, the wind energy market directly utilized over 100,000 full-time-equivalent staff members in a selection of capabilities, including production, project development, construction and generator installation, operations and maintenance, transportation and logistics, and monetary, legal, and seeking advice from services [10] Greater than 500 manufacturing facilities in the United States make parts for wind turbines, and wind power project installations in 2016 alone stood for $13.0 billion in financial investments [11] Environmental sustainability is an additional essential motorist for companies spending in solar power. Many firms have robust sustainability objectives that include lowering greenhouse gas discharges and making use of much less sources to aid lessen their effect on the native environment. There is a growing urgency to deal with climate modification and the pressure from consumers, is arriving degrees of companies.

Simply Solar Illinois Things To Know Before You Buy

As we approach 2025, the combination of solar panels in industrial tasks is no more just an option however a critical need. This blogpost looks into exactly how solar power works and the multifaceted advantages it offers business structures. Solar panels have been made use of on property structures for several years, yet it's only recently that they're becoming more usual in industrial construction.

It can power lights, home heating, a/c and water home heating in business structures. The panels can be set up on rooftops, car park and side backyards. In this post we talk about just how photovoltaic panels work and the advantages of making use of solar power in industrial buildings. Electrical power prices in the U.S. are boosting, making it much more costly for services to operate and a lot more tough to prepare ahead.

The U - Simply Solar Illinois.S. Energy Details Management expects electrical generation from solar to be the leading resource of growth in the united state power industry with the end of 2025, with 79 GW of new solar capacity projected to find online over the next two years. In the EIA's Short-Term Energy Outlook, the firm stated it expects sustainable try this website power's overall share of electrical power generation to increase to 26% by the end of 2025

The Ultimate Guide To Simply Solar Illinois

The photovoltaic or pv solar cell takes in solar radiation. The cords feed this DC power right into the solar inverter and convert it to rotating power (AIR CONDITIONING).

There are numerous means to keep solar power: When solar power is fed right into an electrochemical battery, the chain reaction on the battery parts keeps the solar energy. In a reverse reaction, the current exits from the battery storage for usage. Thermal storage uses mediums such as molten salt or water to preserve and absorb the heat from the sunlight.

Solar panels considerably minimize power prices. While the initial investment can be high, overtime the cost of setting up solar panels is recovered by the money saved on electrical power costs.

The 30-Second Trick For Simply Solar Illinois

By installing photovoltaic panels, a brand name reveals that it appreciates the environment and is making an effort to decrease its carbon impact. Buildings that count totally on electrical grids are at risk to power interruptions that take place throughout poor weather condition or this website electric system breakdowns. Photovoltaic panel installed with battery systems allow business structures to remain to work during power outages.

What Does Simply Solar Illinois Do?

Solar energy is one of the cleanest types of energy. In 2024, property owners can benefit from federal solar tax incentives, allowing them to counter virtually one-third of the purchase price of a solar system via a 30% tax obligation credit.